All around us we see examples of cases where common pool resource problems persist, at least until there is a major crisis. Parties disagree, occasionally on the magnitude or nature of the overall problem, but most often, on the sharing of the costs and benefits of addressing it.

-

-

Mariangela

Ian SeedThree texts

Rupert M LoydellVessel

Melita SchaumSome Guts

Simon Collings (with collages by John Goodby)Three Short Fictions

Meg PokrassThe Campus Novel

Peter RobinsonCharlie Boy and Captain Fitz: A One-Act Play

Alan WallSnapshot, Sachsenhausen and three more poems

Peter BlairSeven short poems

Lucian Staiano-DanielsFour prose poems

Olivia TuckThe Back of Beyond and two more prose poems

Tony KittTwo poems

Moriana Delgadofrom Reverse | Inverse

Lucy HamiltonSix haibun

Sheila E. MurphyKingfishers and cobblestones and five more new poems

Kitty HawkinsZion Offramp 76–78

Mark ScrogginsCome dancing with me and two more new poems

Marc VincenzPlease Swipe Right

Chloe Phillips‘Three Postcards’ and a prose poem

Linda BlackStill Life

Melita SchaumIn memory of

John Taylor with drawings by Sam ForderImmortal Wreckage

Will StoneNew in Translation

Snowdrifts

Marina Tsvetaeva, trans. by Belinda CookePoems from Prière (1924)

Pierre Jean Jouve, trans. by Will StoneSix Prose Poems

Pietro di Marchi, trans. by Peter Robinson -

A new Review of John Matthias’s Some Words on Those Wars by Garin Cycholl.

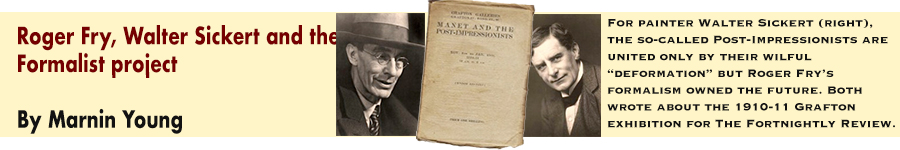

Anthony Howell’s review, A Clutch of Ingenious Authors: Michelene Wandor Four Times EightyOne: Bespoke Stories | Annabel Dover Florilegia | Sharon Kivland Abécédaire

Essays by Alan Wall

· ‘King of Infinite Space’: The Virtue of Uncertainty

· AI: Signs of the Times

· The Lad from Stratford

· Stanley Kubrick: Sex in the CinemaWill Stone’s Missing in Mechelen and At Risk of Interment

G. Kim Blank’s Civilizing, Selling, and T. S. Eliot Curled Up behind the Encyclopædia Britannica

Tronn Overend’s Samuel Alexander on Beauty

AND Conor Robin Madigan’s Master Singer, Simon Collings’s Robert Desnos, Screenwriter, and Igor Webb’s Never Again

New Fortnightly Serials

from The Runiad

Anthony Howellfrom White Ivory

Alan Walland much more below this column.

Departments

-

Contact the Editors here.

-

Audio archive: Two poems, with an audio track, from Heart Monologues by Jasmina Bolfek-Radovani | Daragh Breen’s Aural Triptych | Hayden Carruth reads Contra Mortem and Journey to a Known Place | Anthony Howell reads three new poems | James Laughlin reads Easter in Pittsburgh and five more | Peter Robinson reads Manifestos for a lost cause, Dreamt Affections, Blind Summits and Oblique Lights

Previous Serials

2011: Golden-beak in eight parts. By George Basset (H. R. Haxton).

2012: The Invention of the Modern World in 18 parts. By Alan Macfarlane.

2013: Helen in three long parts. By Oswald Valentine Sickert.

2016: The Survival Manual by Alan Macfarlane. In eight parts.

2018: After the Snowbird, Comes the Whale, by Tom Lowenstein.

LONDON

Readings in The Room: 33 Holcombe Road, Tottenham Hale, London N17 9AS – £5 entry plus donation for refreshments. All enquiries: 0208 801 8577

Poetry London: Current listings here.

Shearsman readings: 7:30pm at Swedenborg Hall, 20/21 Bloomsbury Way, London WC1. Further details here.NEW YORK

10 reliable poetry venues in NYC.

· The funeral of Isaac Albéniz

· Coleridge, poetry and the ‘rage for disorder’

· Otto Rank

· Patrons and toadying · Rejection before slips

· Cut with a dull blade

· Into the woods, everybody.

· Thought Leaders and Ted Talks

· How Mary Oliver ‘found love in a breathing machine.’

AND read here:

· James Thomson [B.V.]

A dilemma for educators:

Philosophy and the public impact.

.

Michelene Wandor on Derek Walcott and the T.S. Eliot Prize.

.Nick Lowe: the true-blue Basher shows up for a friend.

Anthony Howell: The new libertine in exile.

Kate Hoyland: Inventing Asia, with Joseph Conrad and a Bible for tourists.

Who is Bruce Springsteen? by Peter Knobler.

Martin Sorrell on John Ashbery’s illumination of Arthur Rimbaud.

The beauty of Quantitative Easing.